PREMIUM BIS FOR FAMILY

ONE TO ONE PREMIUM COACHING

Registration of Interest

THE BIGGEST CHALLENGES

THAT INVESTORS ARE FACING RIGHT NOW

Very busy with your business and have no time to manage your investments? No time to study, analyse and decide which stocks to invest in after spending all your time with your daily work and family?

You might have no idea how to select and invest in good companies as you don’t really understand the backgrounds of those companies and face difficulty differentiating good businesses from poorly performed ones.

You might have a dilemma about which stocks to invest in after receiving a lot of unknown sources of tips and hence couldn’t make your decisions wisely.

You might not know how to interpret the financial reports of those listed companies, which might help you to analyse their financial backgrounds.

THE BIGGEST CHALLENGES

THAT INVESTORS ARE FACING RIGHT NOW

You might be afraid of investing alone or making decisions by yourself and worried about making mistakes or losses. In the end, you may just choose blindly based on your gut feeling.

Besides, most of us are easily influenced and affected by the fluctuations in share prices and the overwhelming information and market news.

At the end of the day, you really don’t know what to buy and when to buy and sell, thus making your investments like gambling.

All of these are the common problems

encountered by retail investors every day.

HOW DOES

PREMIUM BIS SOLVE YOUR PROBLEMS

We have heard your problems of making personal investments. No worries, we will coach and guide you along your investment journey.

You might not have an in-depth understanding of and own comprehensive research on the market. No worries, we will provide comprehensive investment knowledge coaching, case studies, industries and businesses knowledge to you.

You are not alone. Our professional investment and business coaches will be there to coach and support you with the enhanced decision-making processes.

Hence, you have greater clarity and understand on how to manage your own investment with a clearer vision and better prospect.

WHAT IF THE FOLLOWING

2 PROFESSIONALS EMPOWER YOU IN YOUR INVESTMENTS?

Investment Strategy Coach

Education Alignment

Industry Experts

Industries and Businesses Knowledge

HOW CAN PREMIUM BIS

EMPOWER YOU IN YOUR INVESTMENT JOURNEY?

Educational Alignment

Industries and Businesses Knowledge

Manage Your Investment In “Saving Mode” To Accumulate Good Businesses Opportunities

EDUCATIONAL

ALIGNMENT

Under the Premium BIS, we are serious and practical about managing investors’ expectations. We are committed to providing customised comprehensive investment knowledge coaching, case studies learning and conducting discussion sessions on business opportunities for investors.

As an investor, you will have the opportunity to communicate with your personal Investment Coach and Business Coach via one-on-one communication.

Moreover, at Grandpine, we have 19 years of vast experience in investment education/coaching in which we understand the mentality, investment behaviour, and habit of the majority of retail investors very well.

In addition, investors can learn and improve their investment knowledge during these Educational Alignment sessions, which play a very important role in providing clarity to investors about their investment direction so that they feel secure and are in control of their investments.

INDUSTRIES AND

BUSINESSES KNOWLEDGE

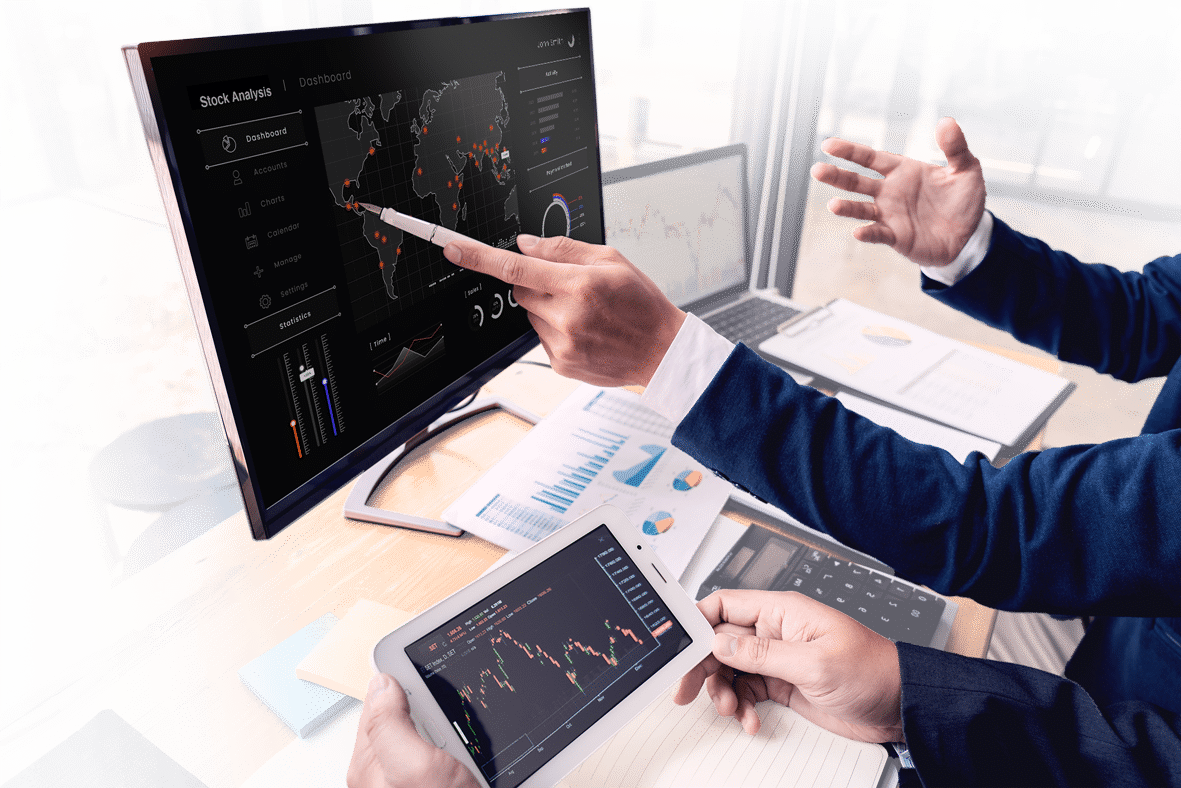

How can we empower you through in-depth industries and businesses knowledge?

One of our advantages is that we have various experienced and hands-on industry experts and practitioners from multiple industries that are proactive in conducting deep dives and in-depth analyses of the management leadership, growth potential, and business goodwill of the listed companies.

Under the Premium BIS, we are dedicated to keeping abreast of the business progress and growth prospects of the listed companies through verification and validation.

We aim to strengthen your understanding and clarity of your enhanced decision-making process via our business insights and explore more business opportunities from various industries in the market.

MANAGE YOUR INVESTMENT

IN “SAVING MODE” TO ACCUMULATE GOOD BUSINESSES OPPORTUNITES

There are various stages in any business’ development cycle – from “infant”, “growth”, “shakeout”, “matured” to “declining” stages. Sometimes the business’ development cycle is affected by external factors such as global economy factors, pandemic, geopolitics issues etc. that may lead to volatile business trend.

Hence, it is wiser if we can adopt a “saving mode” investing methodology in accumulating good businesses opportunities that is able to grasp long term businesses growth and sustainable value creation for their customers, employees, and stakeholders.

In our vast experience, we believe in adopting long-term investing using “savings” methodology that accumulate good investment opportunities while effectively reducing costs of “timing the best market”, it mitigates risks of investing in the wrong timing.

No magic ball can tell you precisely when is the best timing to invest in businesses! So, one of the best solutions is to accumulate it using the “saving mode” investing methodology.

HOW DO WE UTILISE

INDUSTRIES AND BUSINESSES KNOWLEDGE TO STRENGTHEN YOUR CLARITY AND DIRECTION OF BUSINESS INVESTMENT?

Our various experiences and hands-on industry experts and practitioners from multiple industries play very important roles in providing in-depth knowledge on Industries and Businesses Knowledge that can enhance in the understanding of:

Business Model

Cost & Profit Structure

Competitive Advantages

Products & Services

Future Development

Customer Loyalty

Brand Awareness

Management Quality & Leadership

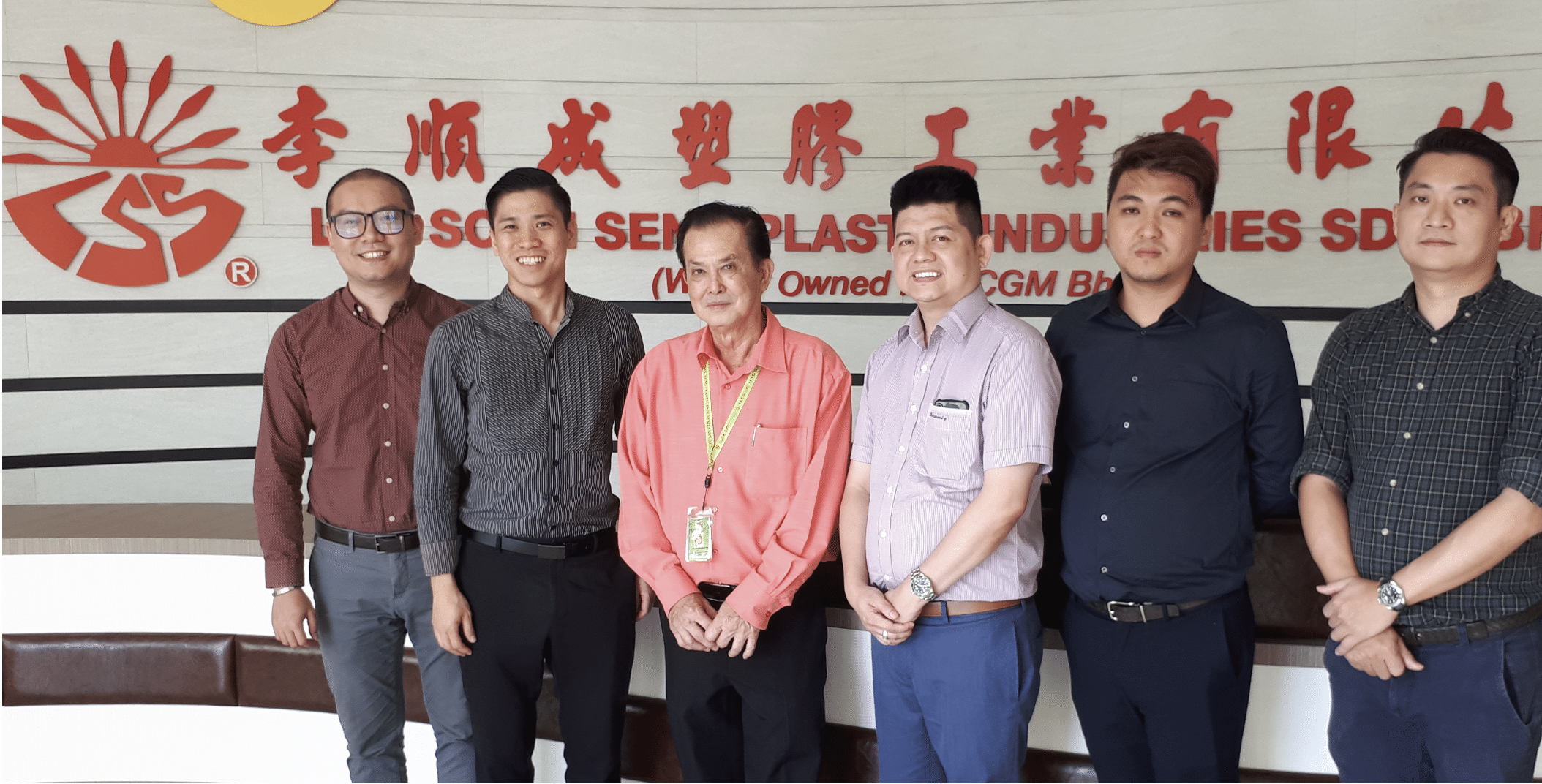

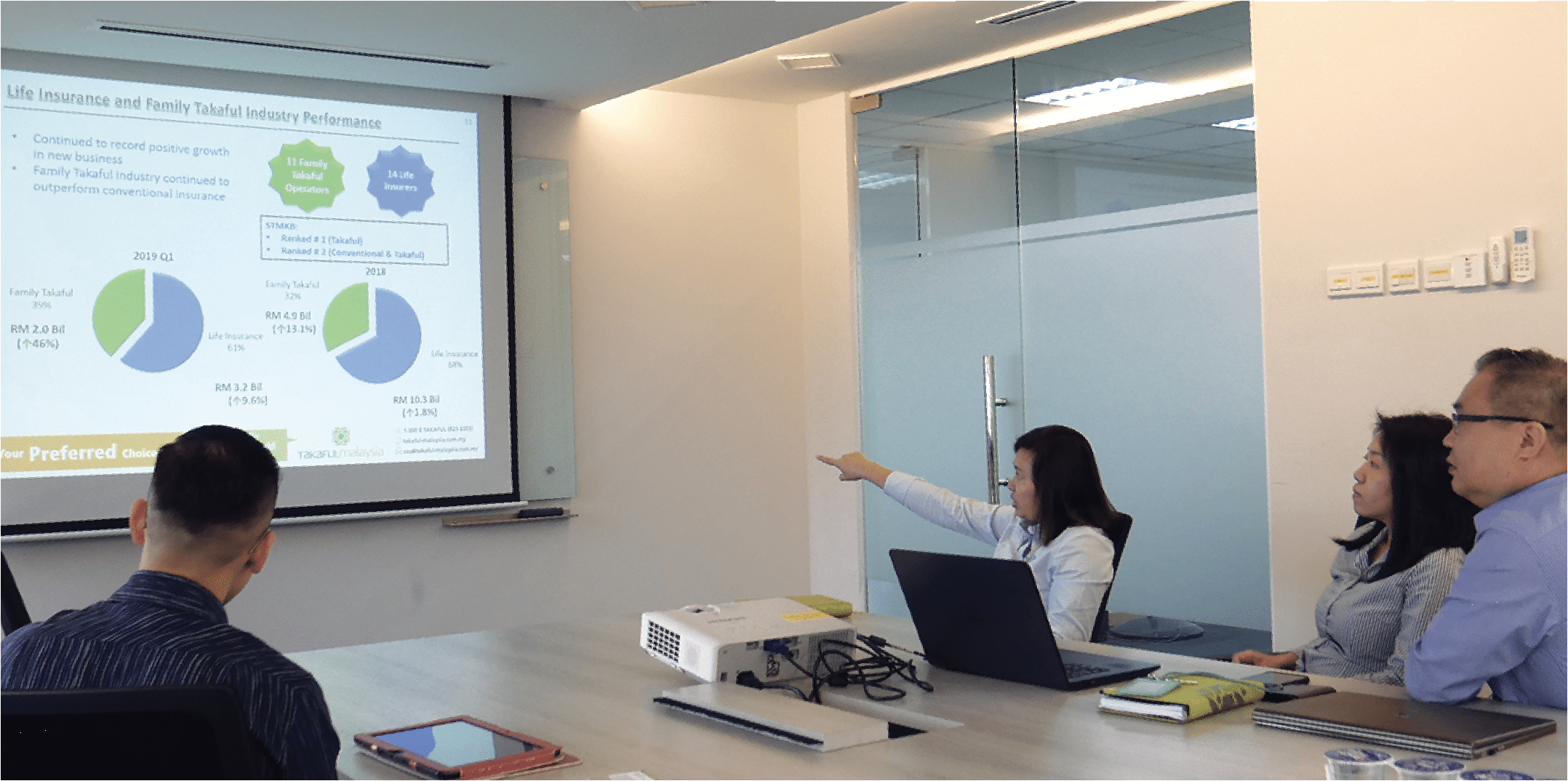

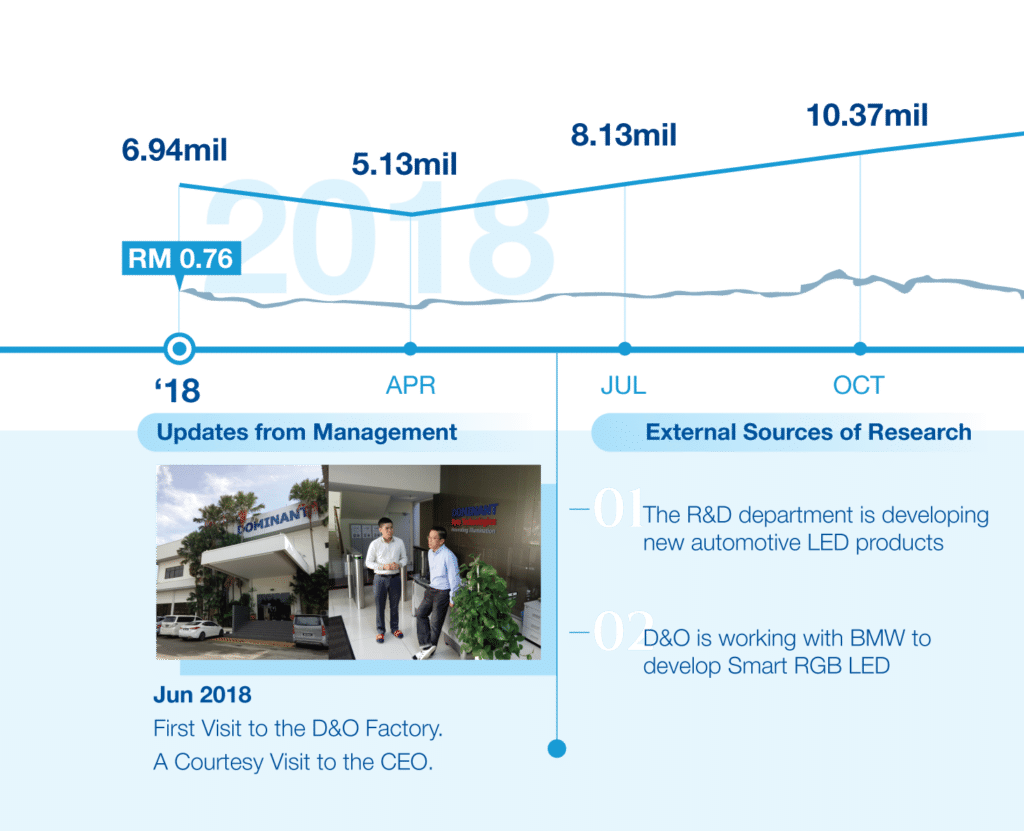

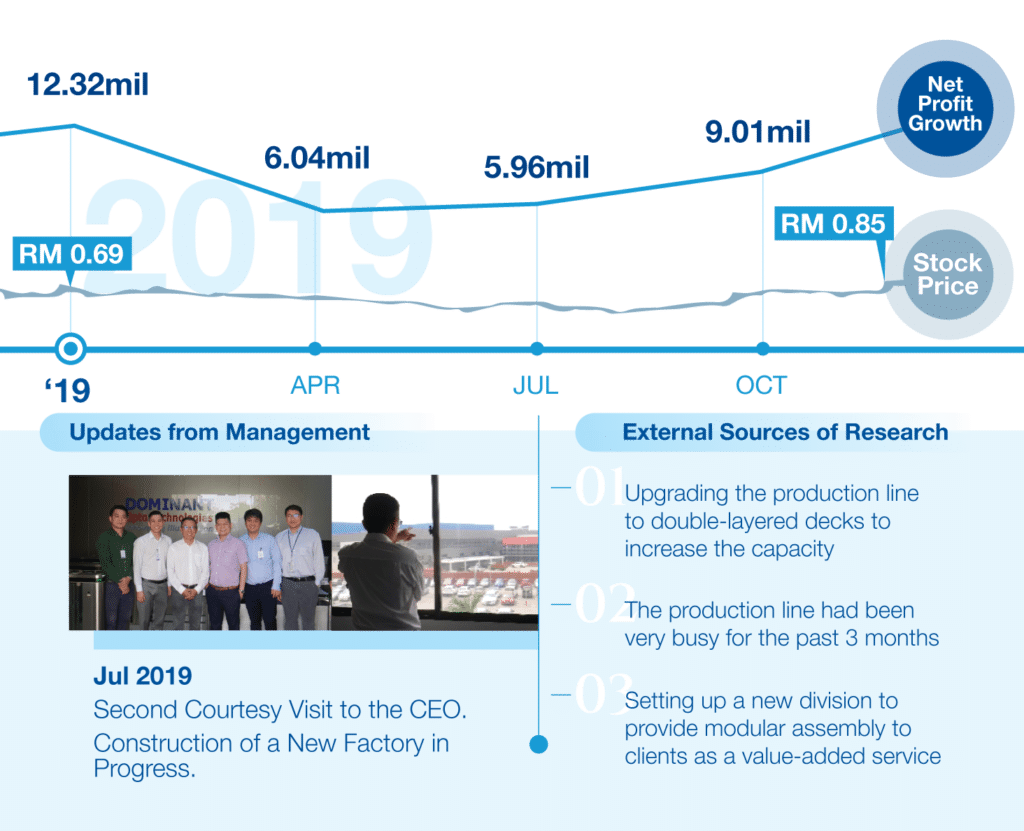

BUILDING RELATIONSHIPS

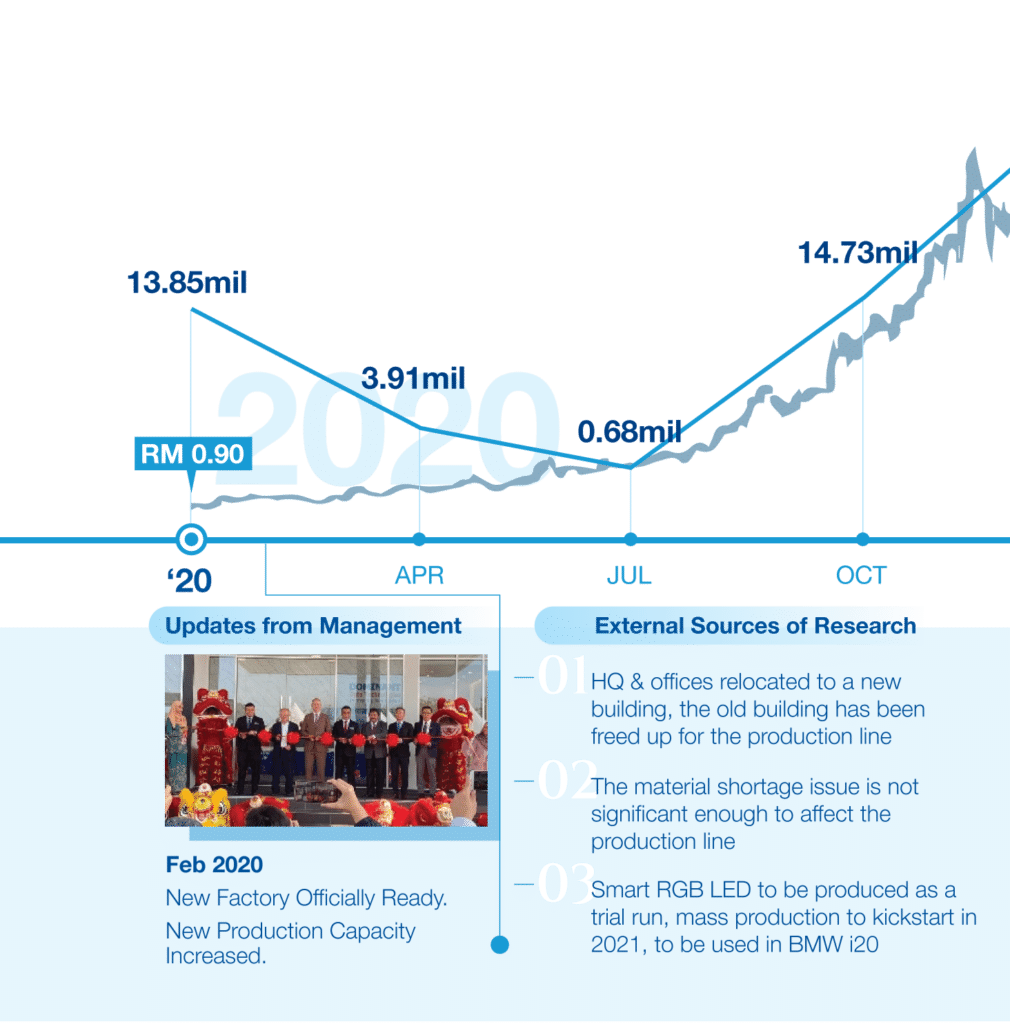

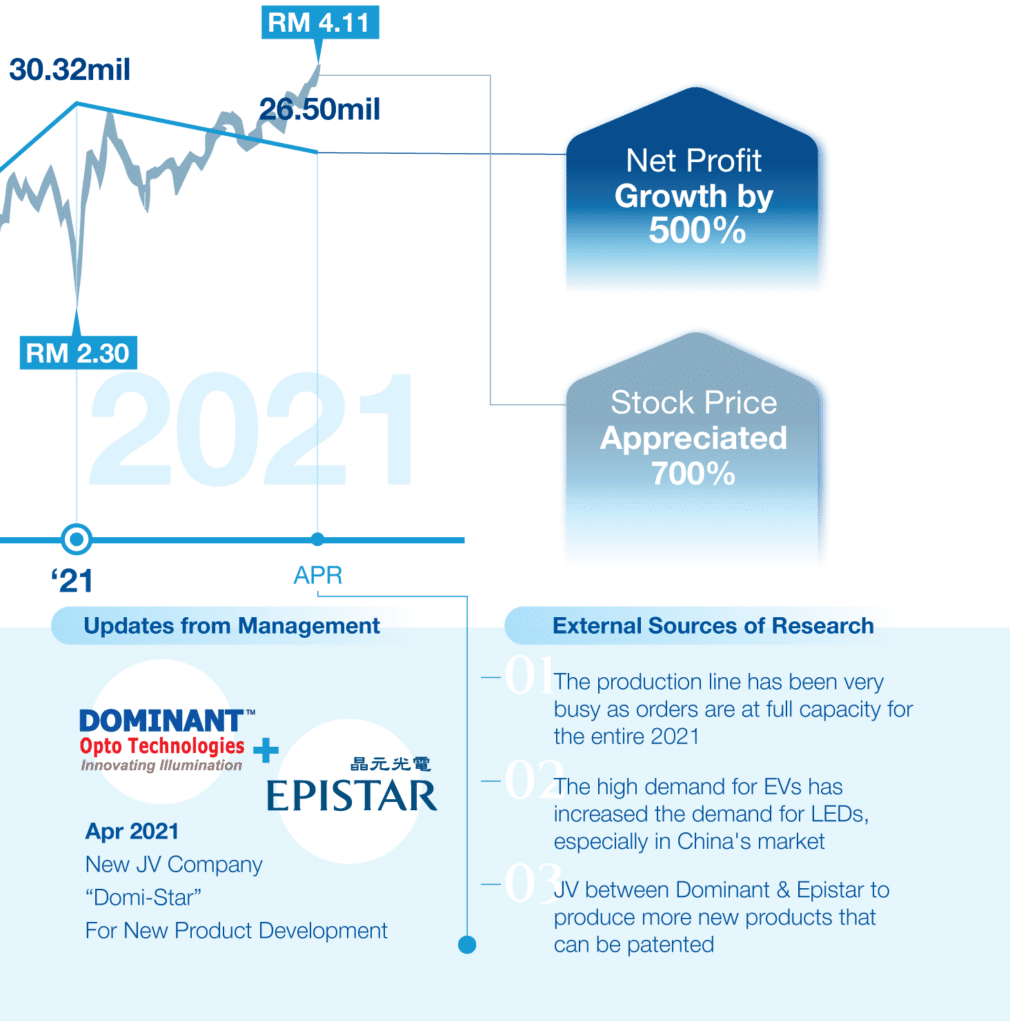

WITH MANAGEMENT

We get quarter / yearly updates from management:

Company Visit

Interview with CEO/CFO/MD/ED

Annual Report & Quarterly Report

BUILDING RELATIONSHIPS

WITH INDUSTRY EXPERTS & PRACTITIONERS

We get external sources of research to provide:

Verify and Validate Information Updates from Management

Progress Tracking of the Business

New Development & Exploration by the Company

Industry & Business Insights Updates

CASE STUDY

D&O

A global LED manufacturer that has undergone a transformation successfully in the automotive LED industry

CASE STUDY

D&O

CASE STUDY

D&O

KEY PERSONS

David Tan

Investment Coach

RESPONSIBILITIES

- Educate, coach and do alignment setting with investors

- Coordinate the External Sources of Research

- Conduct research periodically and checking out updates on businesses and industries for investors

- Review & hold realignment meetings with investors

PROFILE

David Tan is the Vice President, Investment and Group Marketing of Phillip Capital Management Sdn Bhd. He was previously the General Manager (R&D and Product Development) at Grandpine Capital Sdn. Bhd. Bhd.

Currently, there are 20 Marketing Representatives assisting him with fund-raising-related activities. With more than 12 years of investment and coaching experience in Malaysia’s capital market, he had established an investment approach model that is based on Value Investing and Growth Investing.

He assisted in the operation and development of Guangdong KunChen Investment Co. Ltd. in Guangzhou, China that manages high-net-worth clients‘ investment portfolios in the country’s A-share market. In 2019, he passed the Module 9 & 10 licencing exams by the Securities Commission, pursuing his career as a licenced fund manager.

Lee Yon Onn

Business Coach / Advisor

RESPONSIBILITIES

- Coach & advise on business strategies

- Research advisor for industries and business knowledge platform

- Lead the research & development of products and quantitative back-testing strategies

PROFILE

Lee Yon Onn is an expert in asset management, business analysis, mentoring, and corporate management. He possesses multiple business perspectives from eastern and western cultures through the accumulation of considerable management experience in China and Malaysia.

He founded Grandpine Capital, a leading investment education platform in Malaysia, in 2003. He is an industry pioneer in investor education in the nation. In 2008, he started his asset management business in China and founded Guangdong KunChen Investment Co. Ltd. in Guangzhou. Additionally, one of the asset management companies that he co-owned was one of the top 10 performers in private equity in 2009.

In 2018, he joined one of the biggest home furnishing brands in Malaysia, SSF Sdn Bhd, as the Executive Director. He is also a popular author of investment and business books in Chinese. While running his own asset management, education, and retail businesses, he is currently a mentor to investors and business owners, providing guidance to them on value investing through business analysis and strategic entrepreneurship, respectively.

Alfred Chen

Investment Coach

RESPONSIBILITIES

- Conduct fundamental analyses of businesses

- Take initiative in formulating strategies for market research

PROFILE

Alfred Chen is the Chief Coach of Grandpine Capital Sdn. Bhd. He has coached more than 20,000 students at Grandpine Capital and is active on social media platforms as an investment educator with more than 100,000 followers on his Facebook page & YouTube channel. He is also the author of numerous investment books in Malaysia.

He has a vast experience in Malaysia’s stock market and has carried out various in-depth analyses of the listed companies in Bursa Malaysia. He started investing in China’s stock market when he was 11 years old。

Additionally, he had been invited by a few tertiary education institutions as a guest speaker and investment banks and stock broking firms to deliver market talks and analyses of stocks to their clients.

Since 2009, he has been the key speaker at the Investment Forum jointly organised by Sin Chew Daily, Nanyang Siang Pau, and Oriental Daily. He has made an appearance in many TV shows and interviewed by media including Astro Awani, Bloomberg TV, CityPlus FM, and Pocketimes.

Hew SC

Investment Coach / Coordinator

RESPONSIBILITIES

- Educate, coach and do alignment setting with investors

- Coordinate on industries and businesses knowledge platform

- Explore and interact with more industries experts from multiple industries for continuous industries and businesses knowledge platform enhancement

PROFILE

Ms. Hew has more than 10 years of experience in the manufacturing industry. During the tenure she worked with a well-known cigarette brand to successfully develop its new products in the Asia-Pacific region. She also provided printing technical support and quality control for designated suppliers in the Asia-Pacific region.

She is great in coordinating tasks between departments and possess strong communication skills. She has more than 5 years of practical experience in the Malaysian stock market specializing in value investing. Her investment performance has outperformed KLCI with double-digit of annual returns over the years.

Due to her vast experience in people management and strong ability in problems solving, she was promoted to Head of Department of product research department and investment coach in Grandpine Capital. She is great at sorting out large amount of information and identify those which are valuable. Having a clear mind along with good communication skills and affinity have made her advantageous in getting first-hand information from people across the industries.

Justin Foong

Investment Coach

RESPONSIBILITIES

- Educate, coach and do alignment setting with investors

- Explore more information on industries and businesses knowledge to continuous communicating with investors

PROFILE

Alfred Chen is the Chief Coach of Grandpine Capital Sdn. Bhd. He has coached more than 20,000 students at Grandpine Capital and is active on social media platforms as an investment educator with more than 100,000 followers on his Facebook page & YouTube channel. He is also the author of numerous investment books in Malaysia.

He has a vast experience in Malaysia’s stock market and has carried out various in-depth analyses of the listed companies in Bursa Malaysia. He started investing in China’s stock market when he was 11 years old。

Additionally, he had been invited by a few tertiary education institutions as a guest speaker and investment banks and stock broking firms to deliver market talks and analyses of stocks to their clients.

Since 2009, he has been the key speaker at the Investment Forum jointly organised by Sin Chew Daily, Nanyang Siang Pau, and Oriental Daily. He has made an appearance in many TV shows and interviewed by media including Astro Awani, Bloomberg TV, CityPlus FM, and Pocketimes.

PREMIUM BIS FOR FAMILY

ONE TO ONE PREMIUM COACHING